Bull or Bear? Anticipate The Next Big Move with Price Volume Analysis

Watch the video extracted from the live session on 25 Jul 2023 below to find out the following:

How to use Wyckoff's efforts vs results to predict the next move.

The groups that could benefit from the potential market rotation from Nasdaq 100

Identify the key levels using the axis line concept

How to judge the "supply level" to determine if the pullback is healthy

And a lot more

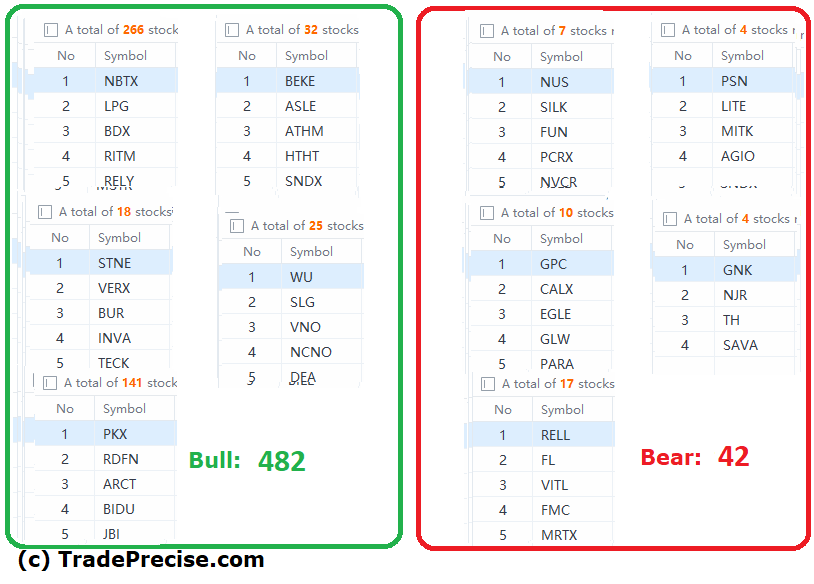

The bullish vs. bearish setup is 482 to 42 from the screenshot of my stock screener below pointing to a positive market environment.

Both the long-term and the short-term market breadth are pointing to a sustainable rally (e.g. buy on dip is back).

12 “low hanging fruits” (YPF, PETQ, etc…) trade entries setup + 20 others (FTNT, TER, etc…) plus 17 “wait and hold” candidates are discussed in the video (51:49) accessed by subscribing members below.

11% in 2 Months

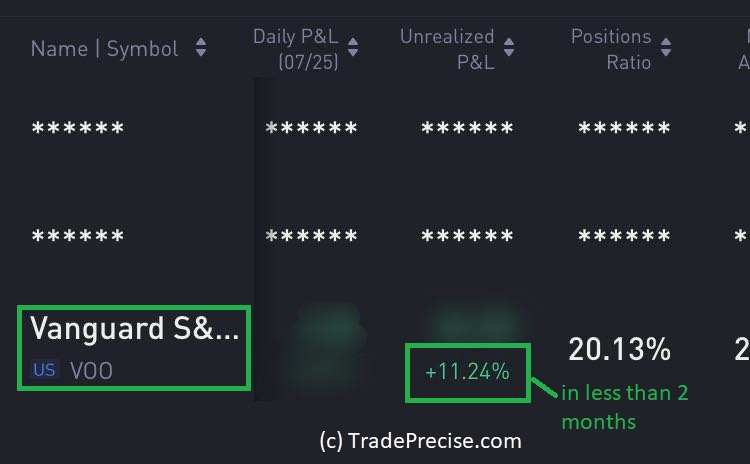

Here is a recent win from a WLGC member in one of her portfolios.

Apart from swing trading the trade setups as discussed during the live session, she is also building a simple retirement portfolio by position trading (i.e. active investing with a technical approach) in S&P 500.

So, position trade for the long term makes a lot of sense as she can take advantage of the compounding effect while avoiding averaging down or catching the falling knife during the bear market.

In less than 2 months, the return of VOO is 11.24%. This is the simplest form of trading or investing, just by following the weekly analysis of the market.

Note: VOO is S&P 500 ETF by Vanguard. In case you are wondering, This ETF has a lower expense ratio compared to SPY, which is great for keeping for the long term.

Like what you see so far?

Click here to join me live every Tuesday so you will get 25++ (and more) actionable stock in a video with entries trigger and stop loss (so that you can calculate the position size), special topics (trading/investing), trade reviews, and get your stock analyzed and questions answered.

Click here to find out how to trade or invest to experience a new level of results from any market consistently without using complex indicators or understanding any financial statement