Welcome back :) This free newsletter contains a detailed market analysis video and 3 actionable stock trading ideas. Upgrade to get 25++ stock setups with a trading plan discussed in the special paid episode.

This paid episode contains:

The premium video (35:58) focuses on the trade entry setup at the key levels and stop loss for both short-term swing and position trading.

Market Discussion

Watch the free-preview video above extracted from the WLGC session before the market open on 28 May 2024 to find out the following:

The significance of volume spikes and bearish change of character bars in predicting market trends

The pivot level to confirm the reversal signal.

The possible scenarios for market trends based on the current trading range and volume patterns.

The immediate downside target for the S&P 500 SPY 0.00%↑ upon confirmation of the reversal signal.

And a lot more...

Market Environment

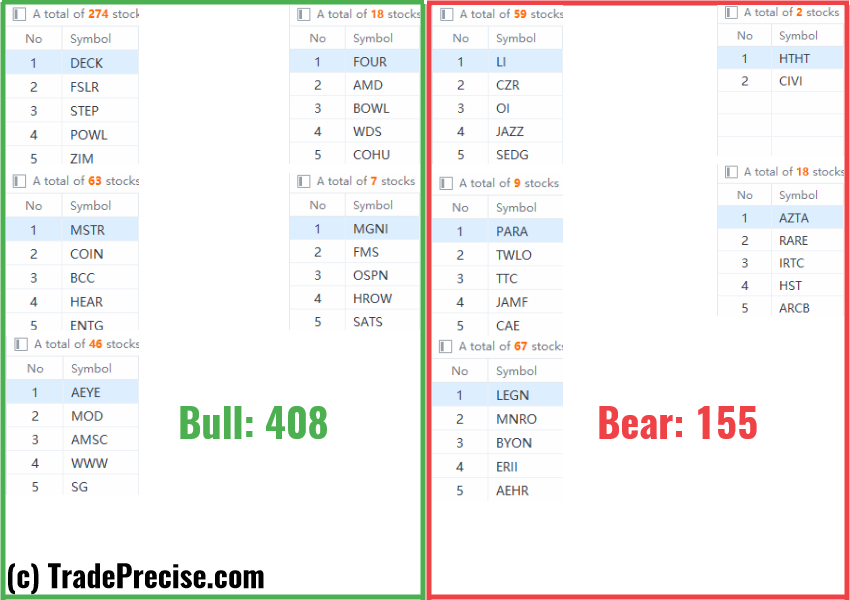

The bullish vs. bearish setup is 408 to 155 from the screenshot of my stock screener below.

The bearish change of character bar with a spike of supply popped up at the all-time high resistance as discussed in the video is a red flag.

On top of that, both the short-term and the long-term market breadth deteriorate. The equal weight RSP 0.00%↑ forming a lower high further confirm the lack of participation of the broad market.

Don’t get overly bearish despite the bearish conditions while we are still waiting for the reversal signal for confirmation.

So far, the note I posted on last Friday (after Thursday’s change of character bar) is still valid.

Refer below:

3 Stocks Ready To Soar

9 “low-hanging fruits” TREE 0.00%↑ VITL 0.00%↑ trade entries setups + 10 actionable setups MU 0.00%↑ were discussed during the live session before the market open (BMO).

Ready to take trading/investing to the next level?

Click here to join me live every Tuesday so you will get 25++ (and more) actionable stock in a video with entries trigger and stop loss (so that you can calculate the position size), special topics (trading/investing), trade reviews, and get your stock analyzed and questions answered, at a fraction of your stop loss per trade.

Click here to achieve consistent success in any market without complex indicators or confusing financial statements.

Subscribe to my YouTube Channel for more free market & stock analysis

Professional free Charting platform: Create an account→ www.TradingView.com

***********************************************************************************************************

Disclosure: If you click the links in this article and make a purchase or open & deposit the required amount into the recommended broker accounts, we earn a commission at no extra cost to you.

Disclaimer: The information in this presentation is solely for educational purposes and should not be taken as investment advice.