🎯 Bulls on Break? Navigating the Aftermath of Up Momentum Burnout

Watch the video extracted from the WLGC session before the market open on 5 Dec 2023 below to find out the following:

How to analyze the shortening of the up wave and its context.

How to interpret the recent increase in the supply level

The 2 immediate support levels (#2 is more meaningful for a major reaction)

How the market is testing the current resistance zone.

And a lot more...

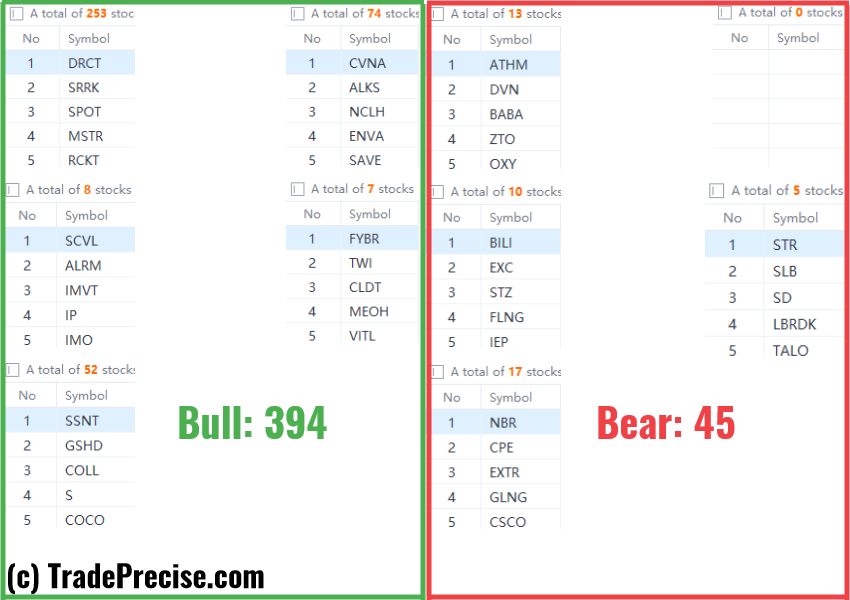

The bullish vs. bearish setup is 394 to 45 from the screenshot of my stock screener below pointing to a healthy and positive market environment.

Both the long-term market breadth (200 MA & 150 MA) are above 50%, which are very healthy for a sustainable rally.

The short-term market breadth (20 MA) is at the overbought level, which is a sign of strength. Watch out for a pullback/consolidation as some stocks are extended.

9 “low-hanging fruits” (FTAI, VRT, etc…) trade entries setup + 19 others ( U etc…) plus 15 “wait and hold” candidates are discussed in the video (45:23) accessed by subscribing members below.

Like what you see so far?

Click here to join me live every Tuesday so you will get 25++ (and more) actionable stock in a video with entries trigger and stop loss (so that you can calculate the position size), special topics (trading/investing), trade reviews, and get your stock analyzed and questions answered, at a fraction of your stop loss per trade.

Click here to find out how to trade or invest to experience a new level of results from any market consistently without using complex indicators or understanding any financial statement.

Below the paywall is:

The premium video (45:23) focuses on the trade entry setup at the key levels and stop loss for both short-term swing and position trading.

9 “low-hanging fruits, 19 actionable setups and 15 “wait and hold” candidates have been discussed in the premium video.

Let me know what you think.