Welcome back :) This free newsletter contains a detailed market analysis video and 3 actionable stock trading ideas. Upgrade to get 25++ stock setups with a trading plan discussed in the special paid episode.

This special paid episode contains:

The full webinar video (1:27:54) focuses on

trade entry setup at the key levels and stop loss for both short-term swing and position trading;

Advanced market breadth analysis

Detailed analysis of 4 major US indices, crude oil, Gold, Silver, Copper, Bitcoin, Dollar Index, etc…

Bearish trade setup to take advantage of the current correction: 2 “low-hanging fruits, 11 actionable setups and 3 “wait and hold” candidates have been discussed in the paid episode.

What to expect and how to position in this market correction.

Market Discussion

Watch the free-preview video above extracted from the WLGC session before the market open on 16 Apr 2024 below to find out the following:

How does the 10-year yield impact the behavior of the S&P 500, particularly during a market correction

The downside target for the S&P 500 should the 10-year yield test the previous high

Under what circumstances could the 10-year yield be used as a leading indicator?

And a lot more...

Market Environment

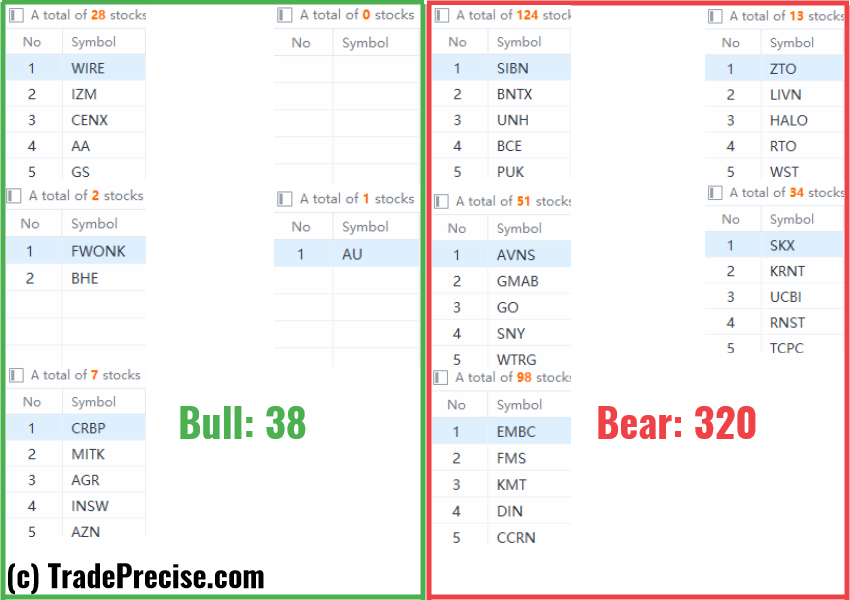

The bullish vs. bearish setup is 38 to 320 from the screenshot of my stock screener below.

There is a significant change in the market and there is only 1 quality long entry setup and many of the short entry setup with the leveraged ETF and the underlying.

The market was spooked by the inflation and this was discussed during last week’s session (Refer to this 2-min YT video - 2-Year Yield Futures Surge Spells Trouble).

Market Comment

1 “low-hanging fruits” TECS (XLK Bear 3X) trade entries setup + 11 actionable setups DRV (XLRE Bear 3X), TSLS (TSLA Bear) have been discussed in the special paid episode (1:27:54) accessed by subscribing members.

Like what you see so far?

Click here to join me live every Tuesday so you will get 25++ (and more) actionable stock in a video with entries trigger and stop loss (so that you can calculate the position size), special topics (trading/investing), trade reviews, and get your stock analyzed and questions answered, at a fraction of your stop loss per trade.

Click here to consistently succeed in any market without complex indicators or confusing financial statements.

Subscribe to my YouTube Channel for more free market & stock analysis

Professional free Charting platform: Create an account→ www.TradingView.com

***********************************************************************************************************

Disclosure: If you click the links in this article and make a purchase or open & deposit the required amount into the recommended broker accounts, we earn a commission at no extra cost to you.

Disclaimer: The information in this presentation is solely for educational purposes and should not be taken as investment advice.