Is the Bull Run Nearing Its End? This is what you could do

Welcome back :) This free newsletter contains a detailed market analysis video and 3 actionable stock trading ideas. Upgrade to get 25++ stock setups with a trading plan discussed in the premium video below the paywall.

Below the paywall are:

The premium video (32:14) focuses on the trade entry setup at the key levels and stop loss for both short-term swing and position trading.

18 “low-hanging fruits, 11 actionable setups have been discussed in the premium video.

Watch the video extracted from the WLGC session before the market open on 9 Apr 2024 below to find out the following:

How to interpret the change of character bar and the structure context to anticipate the next move

The key indicators suggesting potential exhaustion of bullish momentum in the S&P 500

The strong industry groups you should focus on instead.

And a lot more...

Market Environment

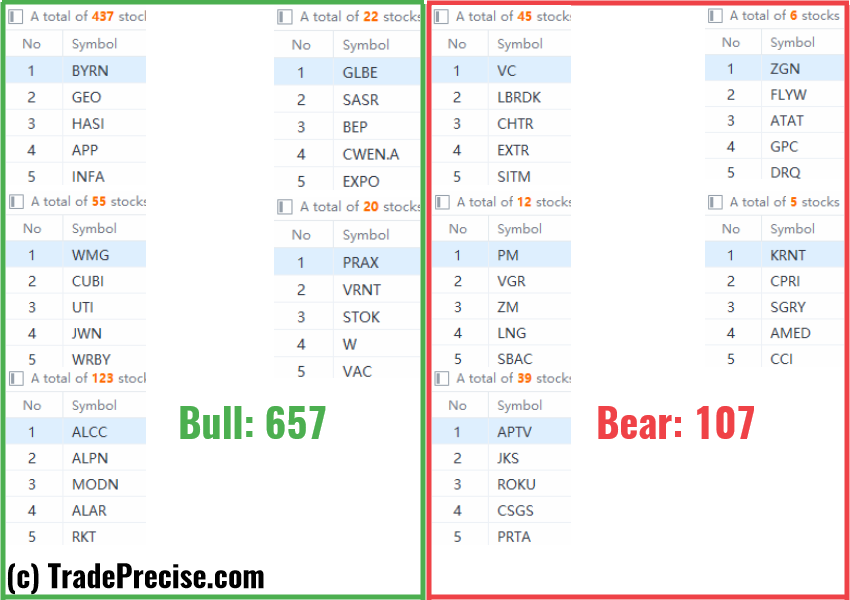

The bullish vs. bearish setup is 657 to 107 from the screenshot of my stock screener below.

Commodities like copper, and crude oil continue to outperform with strong follow-through in individual stocks.

Market Comment

18 “low-hanging fruits” (ARHS, ETRN, etc…) trade entries setup + 11 actionable setups (SCCO etc…) have been discussed in the premium video (32:14) below the paywall accessed by subscribing members.

Like what you see so far?

Click here to join me live every Tuesday so you will get 25++ (and more) actionable stock in a video with entries trigger and stop loss (so that you can calculate the position size), special topics (trading/investing), trade reviews, and get your stock analyzed and questions answered, at a fraction of your stop loss per trade.

Click here to consistently succeed in any market without complex indicators or confusing financial statements.

Subscribe to my YouTube Channel for more free market & stock analysis

Professional free Charting platform: Create an account→ www.TradingView.com