🎯 Is the Stock Market on the Brink of a Meltdown? Here's What You Need to Know

Watch the video extracted from the live session on 27 Sep 2023 below to find out the following:

The deeply oversold level S&P 500 could hit before a technical rally

How to spot outperforming stocks during the correction

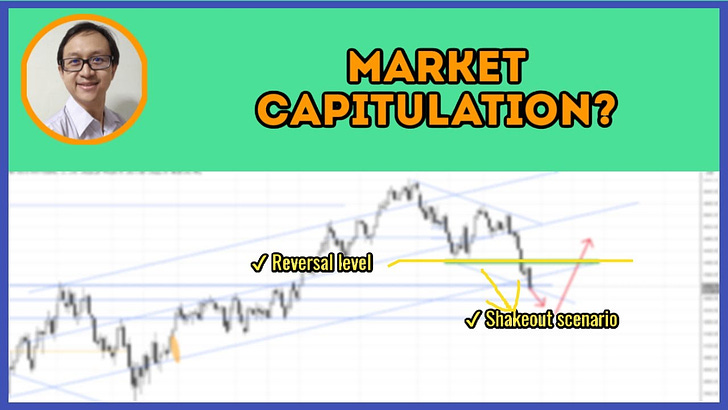

How a shakeout or capitulation scenario could occur

The key level for a trend reversal

And a lot more

The bullish vs. bearish setup is 202 to 320 from the screenshot of my stock screener below pointing to a negative market environment.

The long-term market breadth also points to a negative environment while the short-term market breadth approaches a deeply oversold level, which could be a meaningful condition for a technical rally.

7 “low hanging fruits” (DELL, ET, etc…) trade entries setup + 13 others (TDW, FTI, etc…) plus 23 “wait and hold” candidates are discussed in the video (52:04) accessed by subscribing members below.

If there are stocks bucking the trend (or even consolidating) while the index is going down, they show a lot of relative strength. Those are the stocks that will outperform when the index undergoes a relief rally rebound.

Below the paywall is:

The premium video (38:01) focuses on the trade entry setup at the key levels and stop loss for both short-term swing and position trading.

Let me know what you think.

Like what you see so far?

Click here to join me live every Tuesday so you will get 25++ (and more) actionable stock in a video with entries trigger and stop loss (so that you can calculate the position size), special topics (trading/investing), trade reviews, and get your stock analyzed and questions answered.

Click here to find out how to trade or invest to experience a new level of results from any market consistently without using complex indicators or understanding any financial statement