🎯 Is the Stock Market Ready to Plunge? The Warning Signs are here...

The key level to watch out for a trigger!

Welcome back :) The free newsletter contains a detailed market analysis video and 3 actionable stock trading ideas. Upgrade to get 25++ stock setups with a trading plan discussed in the premium video below the paywall.

Watch the video extracted from the WLGC session before the market open on 20 Feb 2024 below to find out the following:

How to spot the exhaustion of demand.

The bearish analogue you could refer to to anticipate the down move.

The key level S&P 500 needs to break to trigger a selloff.

and a lot more...

If you enjoy my market update in 30s email on Monday, you will want to know the details of how to derive a directional bias based on interpreting the price and volume in the video above.

Market Environment

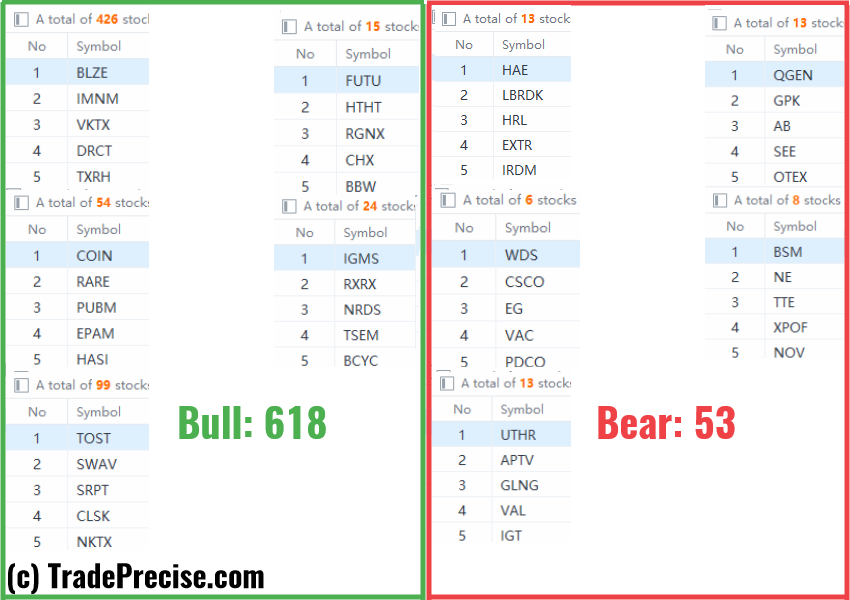

The bullish vs. bearish setup is 618 to 53 from the screenshot of my stock screener below.

The short-term market breadth is still showing bearish divergence, which is another bearish condition to watch out for.

During a market pullback, we can easily identify the true market leaders. So pay attention to the stock setups that show relative strength because they will be the candidates to turn up first (compared to the indices).

8 “low-hanging fruits” (TWST, INBX, etc…) trade entries setup + 16 actionable setups (SNDX etc…) plus 13 “wait and hold” candidates are discussed in the video (33:34) below the paywall accessed by subscribing members.

Like what you see so far?

Click here to join me live every Tuesday so you will get 25++ (and more) actionable stock in a video with entries trigger and stop loss (so that you can calculate the position size), special topics (trading/investing), trade reviews, and get your stock analyzed and questions answered, at a fraction of your stop loss per trade.

Click here to achieve consistent success in any market without complex indicators or confusing financial statements.

Below the paywall are:

The premium video (33:34) focuses on the trade entry setup at the key levels and stop loss for both short-term swing and position trading.

8 “low-hanging fruits, 16 actionable setups and 13 “wait and hold” candidates have been discussed in the premium video.

Let me know what you think.