Watch the video extracted from the live session on 4 Jul 2023 below to find out the following:

Is history repeating itself in terms of market correction or will the current situation take a different path

The potential path of the S&P 500 in the first 2 weeks of July based on price action and the seasonality

An emerging theme consisting of lots of aggressive growth stocks

The key levels to watch out for

And a lot more

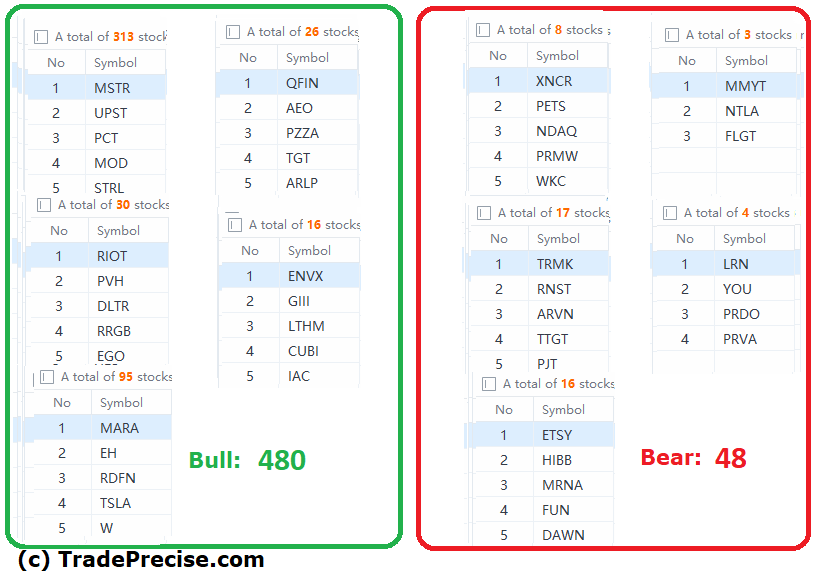

The bullish vs. bearish setup is 480 to 48 from the screenshot of my stock screener below pointing to a positive market environment.

Both the short-term and the long-term market breadth have improved significantly, which tally with the bullish vs. bearish setup as shown above.

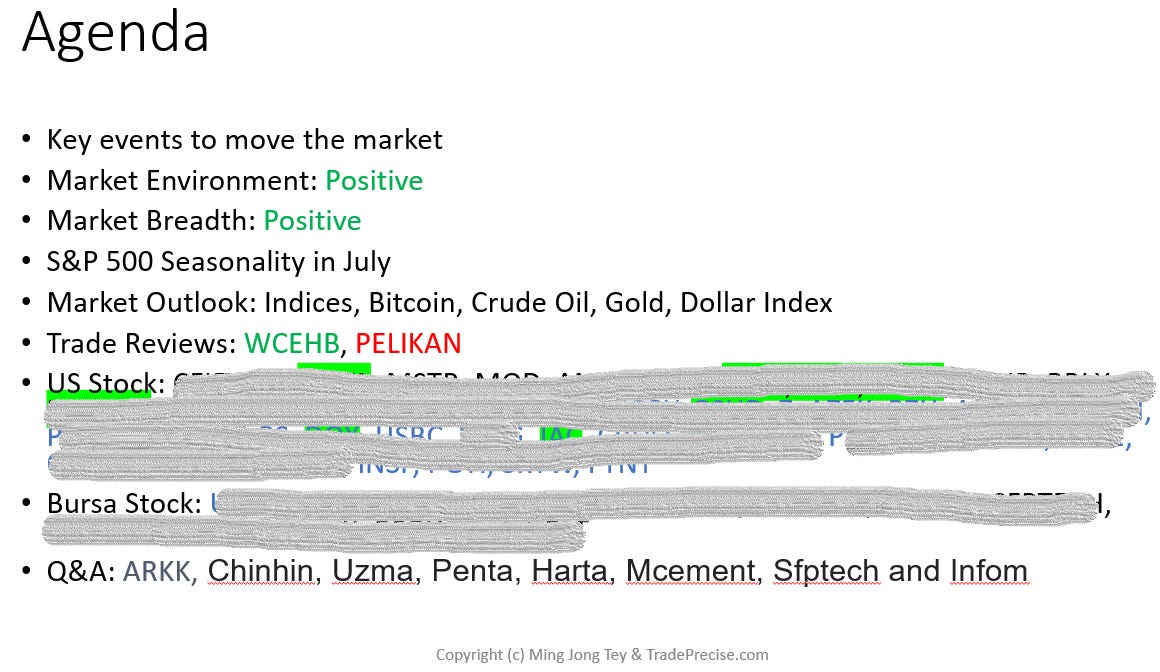

Below is the full agenda for the webinar video (1:52:00) on 4 Jul 2023:

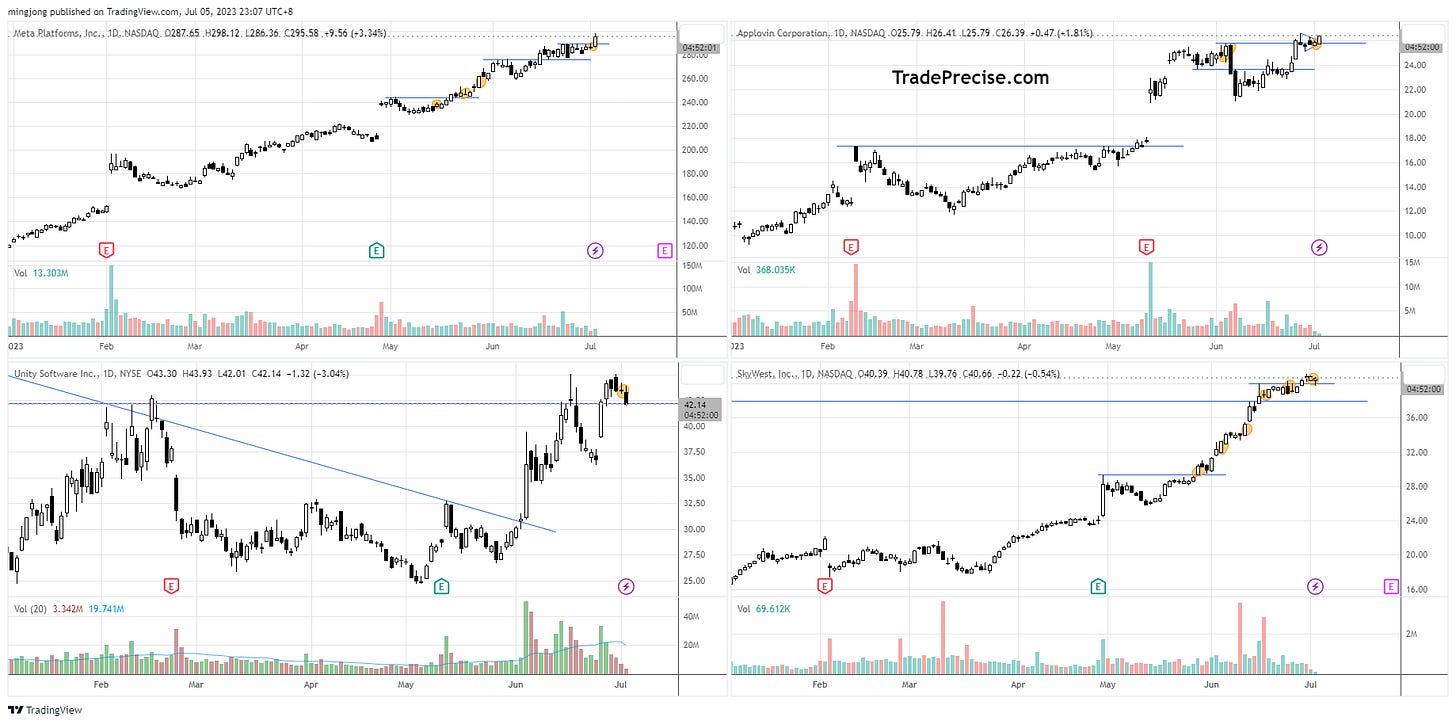

13 “low hanging fruits” (META, APP, etc…) trade entries setup + 38 others (U, SKYW, etc…) are discussed in the video (44:11) accessed by subscribing members below.

Past Trade Setup from 2 weeks ago: Dash

Dash belongs to the ETF - IPO, which is the current emerging theme. There are a lot more great setups as discussed in the stock setup video.

Like what you see so far?

Then sign up as a paid user so you will get 25++ (and more) actionable stock in a video with entries trigger and stop loss (so that you can calculate the position size).

Each weekly premium video (around 30-50 min) is packed with actionable stock setups such as volatility contraction pattern, the breakout from accumulation structure, spring/backup reversal, flag continuation, etc… with a decent reward-to-risk ratio.