Watch the video extracted from the live session on 11 Jul 2023 below to find out the following:

The dilemma the market is facing between the seasonality and the end-of-quarter effect

The ongoing market rotation that will benefit this juicy group

How to derive the likely scenario for S&P 500 using Wyckoff's efforts vs results

The key levels to watch out for

And a lot more

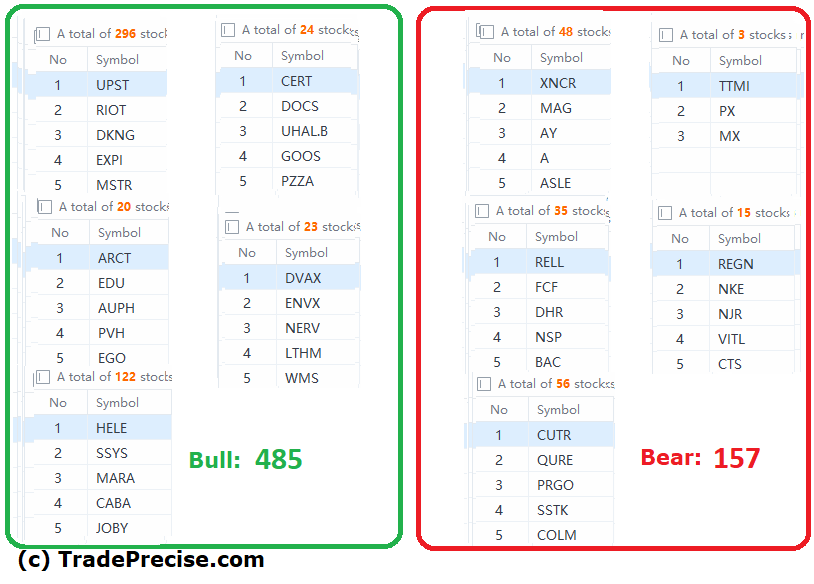

The bullish vs. bearish setup is 485 to 157 from the screenshot of my stock screener below pointing to a positive market environment.

The long-term market breadth is still above 50 while the short-term market breadth pullback slightly. Overall, this still points to a healthy market environment where more than 50% of the stocks are above the 150/200 day Moving Average (MA).

Below is the full agenda for the webinar video (1:37:47) on 11 Jul 2023:

14 “low hanging fruits” (XRT, TTD, etc…) trade entries setup + 38 others (ABNB, BILL, etc…) are discussed in the video (31:54) accessed by subscribing members below.

Trade Setup from 2 weeks ago: GLBE

GLBE was first discussed on 6 Jun 2023 and the subsequent live sessions while the cup and handle pattern is forming the right handle. Our WLGC subscribing member is sitting on an impressive profit of 24.39 % in GLBE in less than 6 weeks!

Congratulations!

GLBE is building a bull flag pending a breakout now, which could be a potential opportunity for scaling in.

Like what you see so far?

Click here to join me live every Tuesday so you will get 25++ (and more) actionable stock in a video with entries trigger and stop loss (so that you can calculate the position size), special topics (trading/investing), trade reviews, and get your stock analyzed and questions answered.

Each weekly premium video (around 30-50 min) is packed with actionable stock setups such as volatility contraction pattern, the breakout from accumulation structure, spring/backup reversal, flag continuation, etc… with a decent reward-to-risk ratio.