🎯 Nasdaq 100 vs. S&P 500 Showdown: Where Should Your Money Be?

Watch the video extracted from the WLGC session on 17 Oct 2023 below to find out the following:

Which one to bet on between the Nasdaq 100 and S&P 500?

The immediate direction, key support and resistance of the S&P 500

The complete trading plan for Nasdaq 100 as it is building the right handle

How could a bearish scenario develop as the war is happening

And a lot more

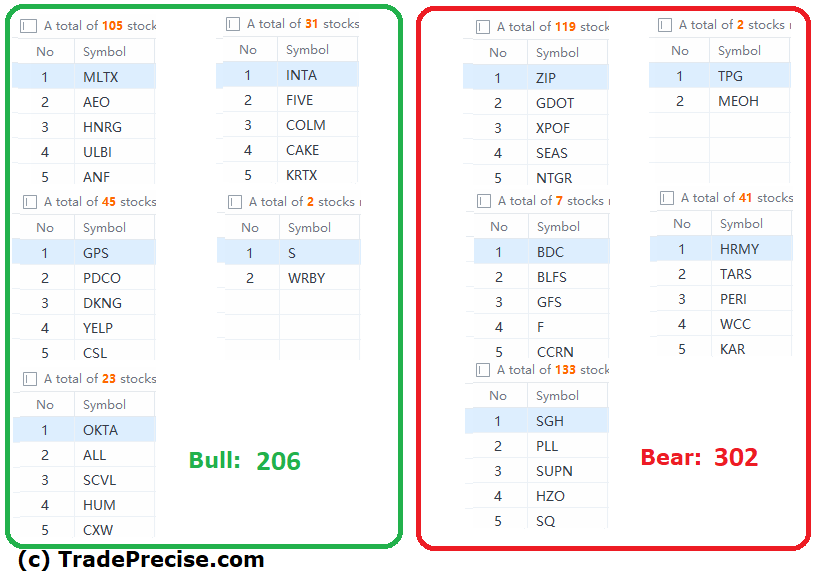

The bullish vs. bearish setup is 206 to 302 from the screenshot of my stock screener below pointing to a negative market environment.

Both the short-term and long-term market breadth are still inferior as the market is still pulling back or at best consolidating. However, Nasdaq 100 presents a swing trading opportunity (refer to the setup as discussed in the video) as it is building its right handle.

7 “low hanging fruits” (AEO, YELP, etc…) trade entries setup + 20 others (WWD, ANET, etc…) plus 38 “wait and hold” candidates are discussed in the video (42:19) accessed by subscribing members below.

Below the paywall are:

The premium video (42:19) focuses on the trade entry setup at the key levels and stop loss for both short-term swing and position trading.

Bonus video: How Seasonality Shapes the S&P 500 & Nasdaq 100 (including the Pre-election years aspect)

Let me know what you think.

Like what you see so far?

Click here to join me live every Tuesday so you will get 25++ (and more) actionable stock in a video with entries trigger and stop loss (so that you can calculate the position size), special topics (trading/investing), trade reviews, and get your stock analyzed and questions answered, at a fraction of your stop loss per trade.

Click here to find out how to trade or invest to experience a new level of results from any market consistently without using complex indicators or understanding any financial statement