Welcome back :) The free newsletter contains a detailed market analysis video and 3 actionable stock trading ideas. Upgrade to get 25++ stock setups with a trading plan discussed in the premium video below the paywall.

Watch the video extracted from the WLGC session before the market open on 13 Feb 2024 below to find out the following:

The key support level for the Nasdaq 100

The directional bias for the long-term, swing and immediate term.

The red flags you need to be aware of in this current market.

and a lot more...

Market update 14 Feb 2024:

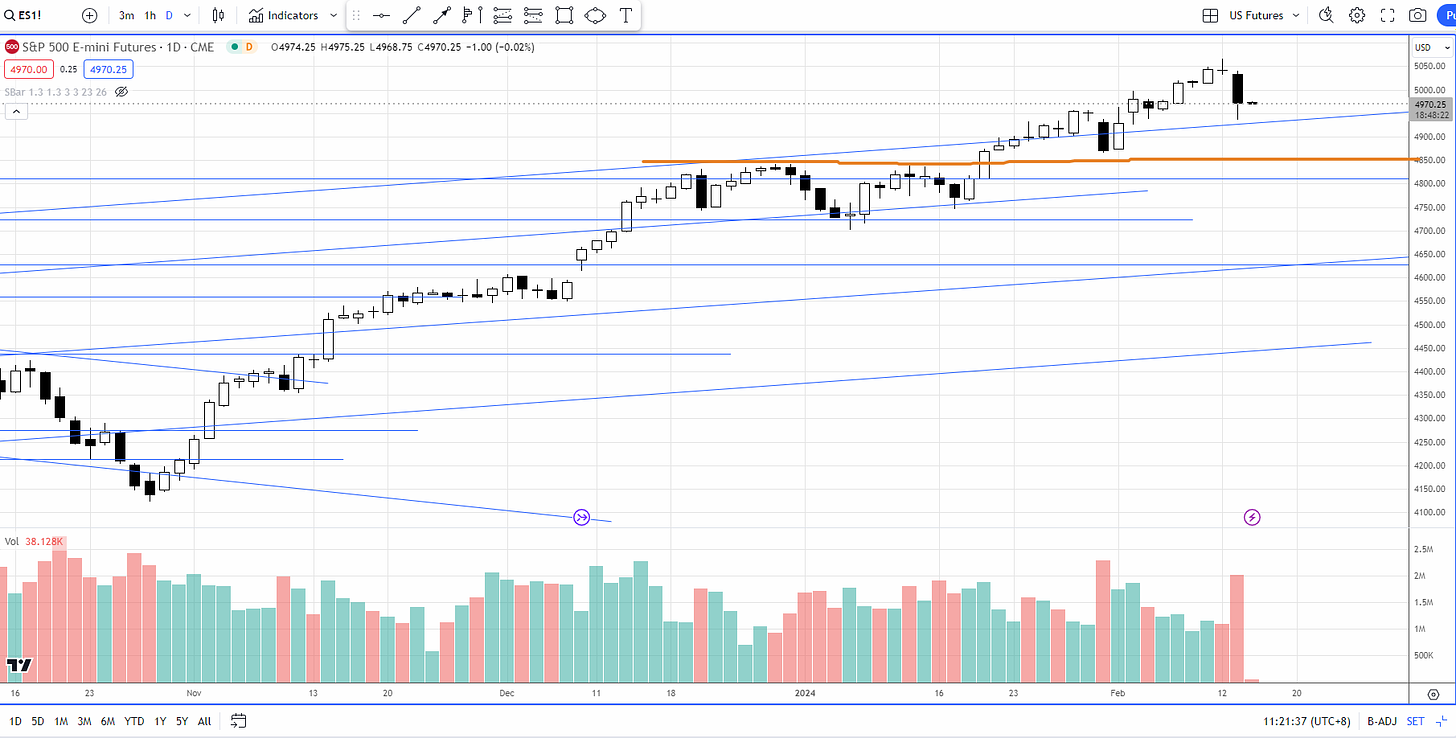

A sharp selloff happened after the live session as the market reacted to the CPI data.

The magnitude and supply are slightly less than 31 Jan 2023. So far yesterday’s drop in S&P 500 (ES) did not pose a great concern yet. 4850 is a meaningful support that needs to hold.

Meanwhile, Russell 2000 (RTY) had a more severe drop, as shown below:

RTY failed at the key level - 2000 twice.

If it breaks below the support at 1925, the major indices like S&P 500, Nasdaq 100, and Dow Jones are likely to join the sell-off as Russell 2000 leads the way down.

A commitment above 2000 is the key to broadening market breadth and the bullish momentum will return.

We will get more clues in the next few days.

Market Environment

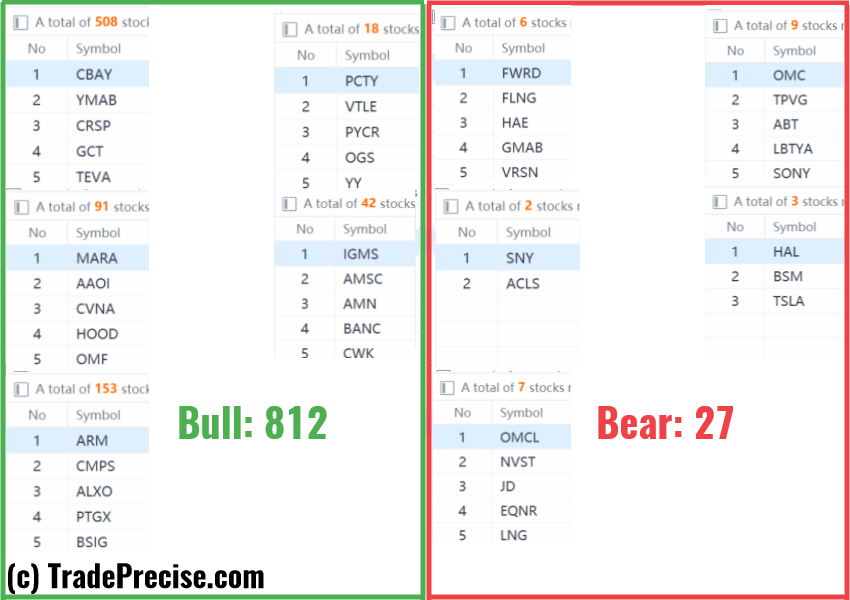

The bullish vs. bearish setup is 812 to 27 from the screenshot of my stock screener below.

9 “low-hanging fruits” (NFLX, CYTK, etc…) trade entries setup + 12 actionable setups (AMD etc…) plus 11 “wait and hold” candidates are discussed in the video (48:42) below the paywall accessed by subscribing members.

Like what you see so far?

Click here to join me live every Tuesday so you will get 25++ (and more) actionable stock in a video with entries trigger and stop loss (so that you can calculate the position size), special topics (trading/investing), trade reviews, and get your stock analyzed and questions answered, at a fraction of your stop loss per trade.

Click here to find out how to trade or invest to experience a new level of results from any market consistently without using complex indicators or understanding any financial statement.

Below the paywall are:

The premium video (34:28) focuses on the trade entry setup at the key levels and stop loss for both short-term swing and position trading.

13 “low-hanging fruits, 11 actionable setups and 16“wait and hold” candidates have been discussed in the premium video.

Let me know what you think.